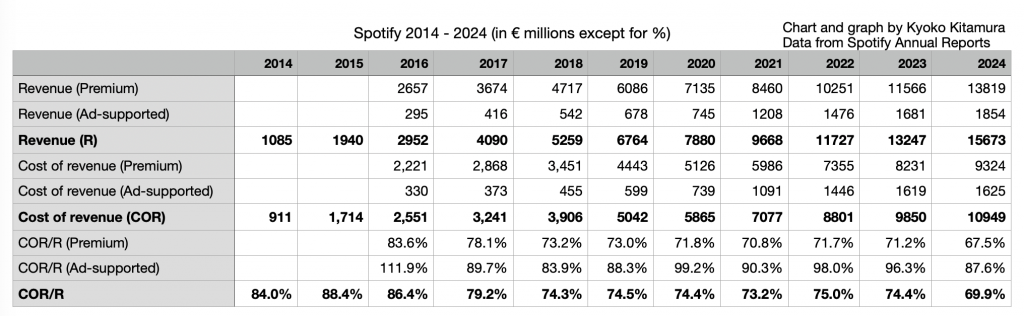

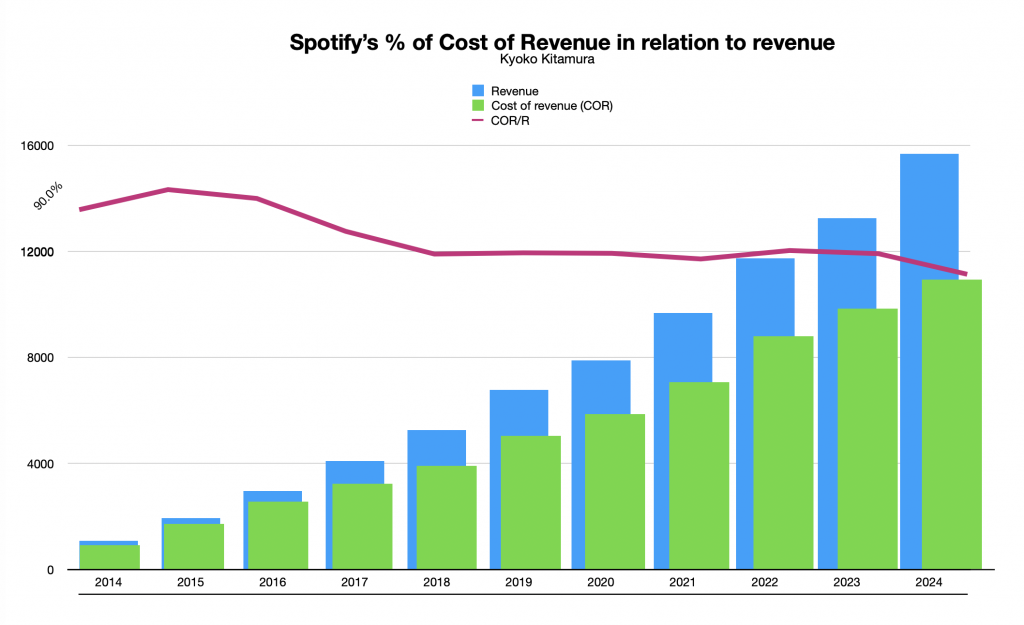

A new era has arrived, one in which Spotify becomes profitable. I pulled numbers from Spotify’s annual reports going back 10 years and one thing stood out yet again: the falling % of cost of revenue to revenue.

Cost of revenue (COR) for Spotify “consists predominantly of royalty and distribution costs related to content streaming.”1 COR typically scales with revenue, so it’s worth looking at why the % may have dropped.

The top table shows available figures for annual revenue and annual COR, with breakouts for Premium and Ad-supported. Most of the revenue from the ad-supported tier went back out as COR, often over 90% and once even topping 100%. Premium tier’s % of COR to revenue has been dropping slowly, but until FY2024 was still hovering above 70.

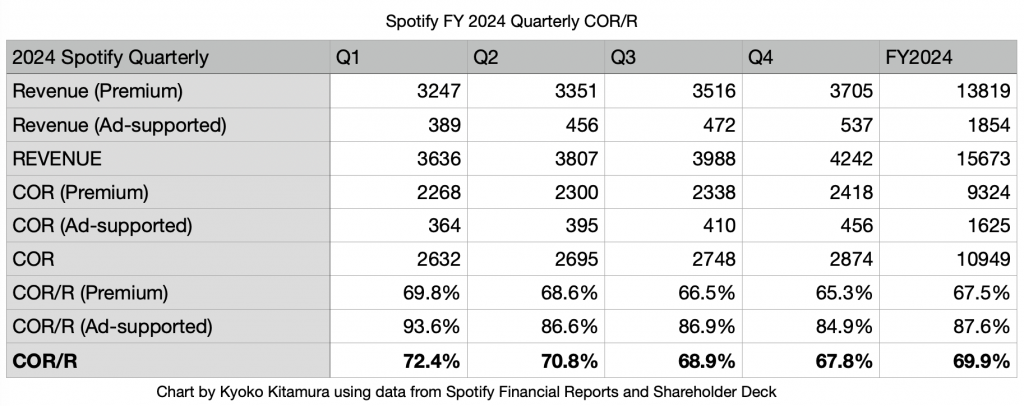

However, things look very different when we look at FY 2024 quarterly numbers (table below).

In FY2024, COR/R for both Premium and Ad-supported were lower. Premium had already fallen below 70%, with a large drop in Q3. Ad-supported had an even larger drop. 2024 Q4 Shareholder deck showed that, for the first time in 10 years, the total annual COR to revenue, with Premium and Ad-supported combined, fell below 70%.

What happened in 2024 and would these developments already have affected the numbers for FY2024?

The Bundle

In March 2024, “bundling” came into effect, allowing Spotify to pay a discounted royalty rate to rights holders. In the U.S., there is currently no music-only tier for new users; it’s either ad-supported or bundled with audiobooks. Billboard wrote in May 2024, “By adding audiobooks into Spotify’s premium tier, the streaming service now claims it qualifies to pay a discounted “bundle” rate to songwriters for premium streams…To determine how great this loss in royalty value would be for the music business, Billboard calculated that songwriters and publishers will earn an estimated $150 million less in U.S. mechanical royalties from premium, duo and family plans for the first 12 months that this is in effect, compared to what they would have earned if these three subscriptions were never bundled. Notably, this change will not impact Spotify’s premium, duo or family pay outs for the first two months of 2024. Bundling kicks in starting in March, so this number refers to losses for the first 12 months after premium, family and duo is qualified as a bundle, not the calendar year of 2024.”2

MLC (Mechanical License Collective) filed a lawsuit in May 2024, which they lost this month. “Although the MLC claimed that Spotify had “unilaterally and unlawfully” cut its music-royalty payments via the bundle, a federal judge ruled that its move was supported by “unambiguous” regulations.”3

Then, a week ago, it was announced that UMG and Spotify has a new agreement. Music Business Worldwide reported the following:

“Our sources maintain that, in terms of royalty sums paid by Spotify to UMPG, the effect of the bundle-related discount over the past year will effectively be nullified going forward, and payouts to UMPG and its songwriters will rise;

However, within the private UMPG and Spotify agreement, there remains a value differentiation between a music-plus-audiobooks user vs. a music-only user.”4

And now, it seems that Warner too has joined the privileged circle.5

1000 Plays Threshold

In April 2024, Spotify stopped paying tracks which did not meet the 1000 threshold, i.e., “tracks must have reached at least 1,000 streams in the previous 12 months in order to generate recorded royalties.”6

Spotify Reaches Profitability

If the COR/R had stayed at around 74.4%, the annual COR would have been around 11661 million €, a difference of roughly 712 million €. Would the discounted royalty rates for “bundling” and 1000 plays threshold show up already in numbers, both implemented in early 2024? Too soon? In any case, by simultaneously raising subscription prices and aggressively cutting costs, including cutting its headcount by 20.4% from 9,123 employees at the end of 2023 to 7,261 over the course of the year7, Spotify finally attained its first full year of profitability since launching in 2008. At this point, it shouldn’t surprise anyone that a leading tech company could keep losing money for 15 years. Nor that, with money and power, a label can cut an advantageous deal with Spotify. But where does that leave the independent artists who may not have that kind of negotiating power?

- “Our royalty payment scheme is complex, and it is difficult to estimate the amount payable under our license agreements or relevant statutes. (p.15)

…Cost of revenue consists predominantly of royalty and distribution costs related to content streaming. We incur royalty costs, which we pay to certain record labels, music publishers, and other rights holders, for the right to stream content to our users. Music royalties are typically calculated monthly based on the combination of a number of different variables. Generally, Premium Service royalties are based on the greater of a percentage of revenue and a per user amount. Royalties for the Ad-Supported Service are typically a percentage of relevant revenue, although certain agreements are based on the greater of a percentage of relevant revenue and an amount for each time a track is streamed. We have negotiated lower per user amounts for our lower priced subscription plans such as our Family Plan, Duo Plan, and Student Plan. In our agreements with certain record labels, the percentage of revenue used in the calculation of royalties is generally dependent upon certain targets being met. The targets can include such measures as the number of Premium Subscribers, the ratio of Ad-Supported Users to Premium Subscribers, and/or the rates of Premium Subscriber churn. In addition, royalty rates vary by country. Some of our royalty agreements require that royalty costs be paid in advance or are subject to minimum guaranteed amounts. For the majority of royalty agreements, incremental costs incurred due to unrecouped advances and minimum guarantees have not been significant to date. We also have certain so-called most favored nation royalty agreements, which require us to record additional costs if certain material contract terms are not as favorable as the terms we have agreed to with similar licensors. Cost of revenue also reflects discounts provided by certain rights holders in return for promotional activities in connection with marketplace programs. Additionally, it includes the costs of discounted trials. Royalties payable in relation to audiobook licenses are generally consumption-based.

Cost of revenue also includes the cost of podcast content assets (both produced and licensed). Amortization of podcast content assets is recorded over the shorter of the estimated useful economic life or the license period (if relevant) and begins at the release of each episode. We make payments to podcast publishers, whose content we monetize through advertising sales in SPAN, which are also included in cost of revenue.

Cost of revenue also includes credit card and payment processing fees for subscription revenue, advertising serving, advertising measurement, customer service, certain employee compensation and benefits, cloud computing, streaming, facility, and equipment costs.” (p. 44)

Konstan, E. & Spotify Technology S.A. (2023). FORM 20-F. In UNITED STATES SECURITIES AND EXCHANGE COMMISSION [Report]. https://s29.q4cdn.com/175625835/files/doc_financials/2023/ar/26aaaf29-7cd9-4a5d-ab1f-b06277f5f2a5.pdf ↩︎ - Robinson, K. (2024, May 9). Spotify to pay songwriters about $150 million less next year with Premium, Duo, Family Plan changes. Billboard. https://www.billboard.com/business/streaming/spotify-songwriters-less-mechanical-royalties-audiobooks-bundle-1235673829/

↩︎ - Aswad, J. (2025b, January 31). Variety. Variety. https://variety.com/2025/music/news/spotify-wins-lawsuit-bundling-royalties-1236289823/ ↩︎

- Ingham, T., & Ingham, T. (2025b, January 26). Confirmed: Spotify and Universal have a new deal – including a direct agreement with Universal Music. Music Business Worldwide. https://www.musicbusinessworldwide.com/confirmed-spotify-and-universal-have-a-new-deal-including-a-direct-agreement-with-universal-music-publishing-group-in-the-us/ ↩︎

- Ingham, T., & Ingham, T. (2025d, February 6). Warner Music Group and Spotify ink new deal – overriding controversial CRB ‘bundling’ payment. Music Business Worldwide. https://www.musicbusinessworldwide.com/warner-music-group-and-spotify-ink-new-deal-overriding-controversial-crb-bundling-payment-structure-in-the-us/ ↩︎

- Modernizing Our Royalty System to Drive an Additional $1 Billion toward Emerging and Professional Artists – Spotify for Artists. (n.d.). https://artists.spotify.com/blog/modernizing-our-royalty-system ↩︎

- Spangler, T. (2025, February 4). Variety. Variety. https://variety.com/2025/digital/news/spotify-q4-2024-earnings-first-full-year-profit-double-down-music-1236296518/ ↩︎